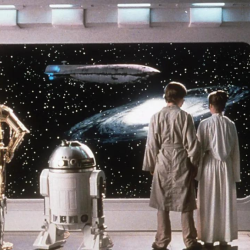

Today, all eyes are on Connected TV (CTV), quite literally. In 2020, a year spent largely indoors, television was a window to the outside world for viewers. With the closure of cinemas and releases of new streaming services such as Disney Plus, the options for high-quality content to consume in the home have never been more numerous. People are using their television sets for far more than the traditional linear viewing. It’s a golden age of television and from gaming to streaming to catching up on demand, the capabilities of smart TVs are ever-growing. TV is the true entertainment hub of the home.

As the CTV ecosystem expands thanks to advancements in technology, a whole new playground opens up for advertisers. Many are aware of how their viewers’ consumption habits have changed, but have yet to account for the fragmentation of audiences across what was once a single-use device. Increased over-the-top (OTT) content consumption has made CTV an appealing new medium they are keen to learn more about.

However, with viewers spoilt for choice bouncing between SVOD, BVOD, AVOD and other services like music streaming and even TikTok via the TV, it can be a hard task to figure out what each of these VODs are, let alone where audiences have decided to settle. In order to grasp this ever-growing landscape, understanding some of the prominent viewership trends is helpful to decipher where ad dollars are best spent. Don’t worry about the acronyms – all will become clear.

An audience divided

When referring to CTV we often see people discuss linear versus OTT. Linear viewing is what we would associate with the traditional scheduled programming, the likes of BBC, ITV and Channel 4. This type of programming is pre-scheduled for the audience to sit back and enjoy curated content that is usually ad-supported. For many years this was the entirety of television and it still makes up a large part of viewing today. In fact, our data shows the heaviest linear watchers are extremely engaged, with 33% of the entire Samsung TV population consuming 75% of all linear minutes.

OTT viewing refers to streaming media that is consumed via a connection to the internet and has grown ever more popular as more and more people own smart, internet-connected TVs. Those viewers who prefer to consume content this way are also extremely loyal. Fourteen per cent of Samsung TVs can be considered ‘Streamers Only’. These devices consume, on average, 94 hours of streaming hours per month.

A monumental shift

In 2020 we witnessed a monumental shift towards streaming. Our ‘Behind the Screens’ report unveiled that streaming now accounts for more TV time than linear on the 5.8 million Samsung TVs in the UK: making up 59% of all TV viewing time. This means that audiences are spending more time watching the likes of subscription-video-on-demand (SVOD) services like Netflix, ad-supported-video-on-demand (AVOD) services like Samsung TV Plus and broadcast-video-on-demand (BVOD) services like All4 than ‘traditional’ linear TV. It’s important not to discount linear television altogether (with 41% of content being consumed this way), but this monumental shift highlights the need to incorporate a streaming strategy into a holistic media plan.

For advertisers, it’s crucial that they do not overexpose linear viewers to their ads while completely ignoring the 14% who are streamers-only, along with the 72% who mix and match. For audiences, content is king. Consumers are able to watch what they want, when they want because technology has made platform surfing so simple that convenience is now assumed to be part of the package. Advertisers cannot afford to see streaming as a new, up-and-coming medium; our data shows that it’s already becoming the go-to way to consume content and is a trend that’s here to stay.

In CTV, advertisers have an entire ecosystem at their disposal and while this vast landscape can be daunting, the viewers it attracts are numerous, diverse and highly engaged.

Emerging opportunities

Streaming services like Netflix and Disney Plus alongside linear viewing tend to dominate the conversation around CTV. But our insights prove that the CTV landscape is far more extensive than this. One of the biggest emerging trends we see this year is gaming. On Samsung devices, gamers are able to hop in and out of gaming streaming services such as Steam Link as well as access their plug-in consoles.

AVOD is also a rapidly growing trend – we saw demand for this jump by 29% in the first half of 2020. The number of subscription services consumers are willing to commit to is limited, and while demand for quality content is still high, ad-supported video services are able to service this need. Seeing the opportunity for full screen, non-skippable, brand safe ads delivered on the large screen (in fact, the average screen size in the UK is 55″), the appetite for AVOD is huge, and it is a major opportunity for advertisers.

Inventory opportunities

Crucially, CTV means that advertisers are no longer limited to the 30 second TV ad slots once associated with television. Now, advertisers are able to make use of a brand new range of ad-formats that might be far better suited to their creative vision and budget. Samsung TVs, for example, offer a range of different experiences – from TV Plus premium video or channel sponsorship to home screen engagement which links directly to a microsite or smart TV app. These enable engagement with the viewer the moment they turn the TV on and are in content discovery mode – choosing what to watch. Brands can suggest channels, content, apps and branded messaging to the viewer before they move into their chosen channel or service. This approach is extremely helpful in reaching those ‘hard-to-reach’ audiences such as gamers or streamers.

In CTV, advertisers have an entire ecosystem at their disposal and while this vast landscape can be daunting, the viewers it attracts are numerous, diverse and highly engaged. The only way to make the most of CTV is by following audience trends closely and being adaptable to changing viewer behaviours. The medium may keep advertisers on their toes but ultimately with viewing on the rise, the opportunities are plentiful.

Featured image: Manuel Esteban / Shutterstock.com