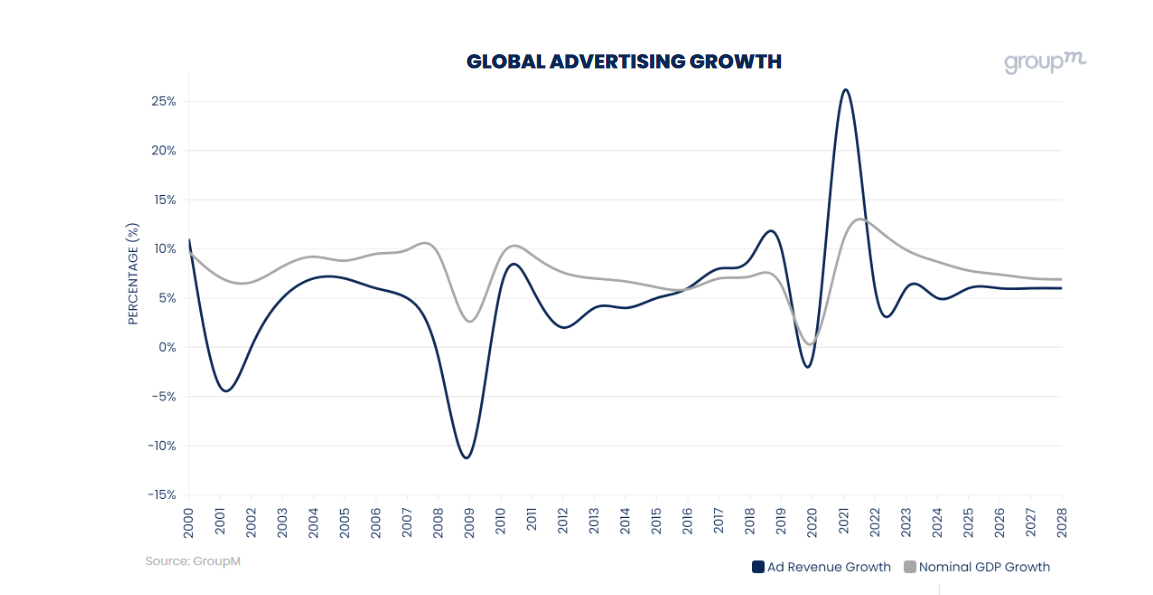

GroupM has released its end-of-year forecast, exploring how external factors spanning socioeconomic, technology, culture, government, and the economy will impact advertising over the coming months and years.

The This Year Next Year global report compiled data across CPG, auto, entertainment, luxury, tech and ‘digital endemics’ to help better understand the flow of advertising revenue from advertiser categories.

Key findings:

- In 2023, global advertising revenue is forecast to grow 5.8%, totalling $889.0 billion, and is estimated to decelerate in 2024 to 5.3%.

- Television, including CTV, is the third largest major channel for global ad revenue (behind search and ‘other digital’), falling to 17.9% of the total in 2023.

- Retail Media is growing quickly, adding more than $10 billion in revenue in 2023 and forecast to grow 8.3% in 2024. Revenue in 2023 is estimated to be $119.4 billion, a downgrade from GroupM’s June report forecast of $125.7 billion.

- Television, including CTV, is the third largest major channel for global ad revenue, falling to 17.9% of the total in 2023.

- The U.S. and China remain the two largest markets in terms of ad revenue, in that order.

- The U.K. (+4.4% in 2023) has replaced Japan (+4.0%) in the number three spot.

The future of digital

According to the report, pureplay digital, excluding the digital extensions of traditional media such as CTV and digital out-of-home (DOOH), but including YouTube and TikTok, will finish the year up 9.2%, better than GroupM’s June forecast of 8.4% (excluding U.S. political advertising).

By 2028, pureplay digital will be larger than the entire advertising industry was in 2022.

In 2023, 69.4% of advertising revenue is classed as digital, with that figure expected to reach 75.5% by 2028.

Other channel updates

- Search is expected to reach nearly $200 billion in revenue in 2023, growing 6.8%. This will be followed by a 7.3% increase in 2024, potentially fueled in part by increased interest and competition in the sector following the integration of generative AI in search results.

- Out-of-home (OOH) is forecast to grow 10.3% in 2023, although it will not surpass 2019 levels until 2024 and, as it stands currently, is not expected to regain its pre-pandemic share of total ad revenue even by 2028.

- Audio ad revenue, including streaming audio, will total $26.4 billion in 2023 (a decline of 2.9% compared to 2022) and is forecast to grow just 0.4% in 2024.

- Print, including both traditional and digital forms of newspapers and magazines, is expected to decline 4.6% in 2023 and 3.1% in 2024. Digital extensions of news are forecast to make up 42.4% of total news ad revenue in 2024 compared to 29.5% for audio.

- Cinema ad revenue is forecast to grow 14.7% in 2023 before decelerating to 3.4% in 2024.

Read the full report here.

Featured image: Karolina Grabowska / Pexels