There’s a buzz about the connected TV world and with good reason, as eyeballs and ad dollars migrate towards internet-streamed forms of television. However, as striking as that growth has been to date, CTV faces a number of challenges before it can step out from the shadow of its linear broadcast cousin.

Ad-funded streaming on the march

As outlined in WARC Media’s latest report Connected TV’s next episode, audiences are switching to CTV in their droves. Smart TV ownership is proliferating: more than four-fifths (83%) of American households are CTV-enabled, according to TVision.

Moreover, those CTV audiences are increasingly likely to turn to ad-funded alternatives, including free ad-supported TV (FAST) channels and lower-cost subscription tiers offered by Netflix and Disney+. Research by Antenna found that one-in-three (32%) US SVOD sign-ups go to ad-supported plans.

Marketers are responding to this shift. CTV ad investment is expected to reach $25.9bn globally in 2023, up 13.2% year-on-year, per GroupM, and is forecast to grow at an average of 10.4% over the next five years. These kinds of numbers would be the envy of almost every corner of the media market. Yet, the closer we look, the less impressive that growth appears to be.

Analysis by WARC Media found that the share of total global ad spend going towards premium video advertising has actually decreased by 14% over the past eight years. In other words, while CTV has attracted some new-to-TV advertisers, it appears to have done little to boost TV’s overall standing in budget allocation terms. Brian Wieser, a renowned ad industry analyst, argues in the report that CTV is ‘just another grouping of television’s inventory‘, and that the additional spend we are seeing merely reflects existing TV advertisers looking in new places for reach in high-quality, professional video environments.

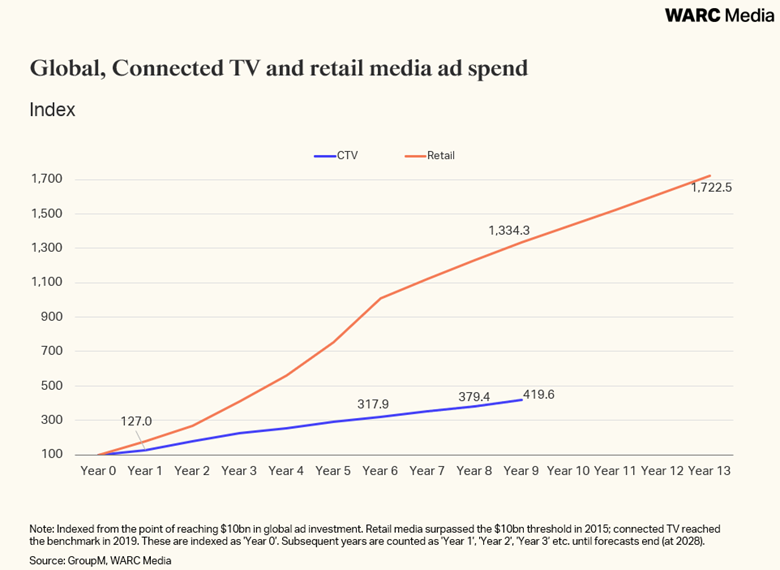

We are not seeing the kind of ‘hockey-stick’ growth curve witnessed with other digital channels, most recently in the case of retail media, where ad spend is growing three times as quickly as in CTV.

Finding new purpose for CTV

Media owners and ad tech vendors have hyped CTV as offering the ideal synthesis of TV reach and digital addressability. In reality, neither claim is without issue. Yes, audiences are migrating to CTV. Gen Z viewers are forecast to spend an average of 90 minutes per day on average on streaming, versus 86 minutes on linear TV, GWI data shows. However, consumption is fragmented across multiple platforms and ad ecosystems, making incremental reach harder to achieve. That fragmentation also has implications for measurement, and CTV’s supposed addressability credentials. Too often, brands must untangle conflicting forms of CTV measurement, making it harder to build a true picture of campaign performance. With streamers like Netflix, Amazon and Disney building their own first-party data supplies, marketers face the prospect of a new collection of ‘walled gardens’, only this time in TV.

Other concerns are inhibiting the rise of CTV. We are seeing worrying levels of criminality, for instance. Research by DoubleVerify suggests unprotected CTV campaigns will experience a fraud rate of 11.2%. Brand safety may also be harder to maintain as FAST channels grow in number and programmatic audience targeting becomes the norm.

Yet the greatest challenge may be in finding an appropriate role for CTV in brands’ media strategies.

CTV’s reach will never be as vast as that achieved by linear TV in decades gone by, nor can it match channels like search or retail media when it comes to sales conversion. Nevertheless, there is huge value in reaching large audiences watching high quality content on a large screen, with a more efficient approach to trading and targeting.

Only by finding a new role can CTV grow beyond the linear TV world from which it has emerged.

Featured image: Marques Kaspbrak / Unsplash