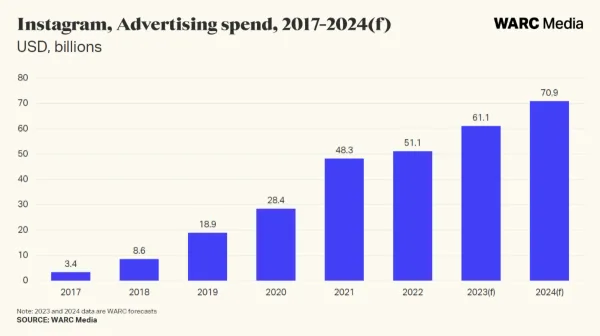

Instagram, impacted by the introduction of Apple’s App Tracking Transparency (ATT) policy in 2021 and a subsequent weakening of the digital ad market, is recovering stronger than its social media peers.

WARC Media forecasts Instagram’s advertising revenue to reach $71bn in 2024, driven by parent company Meta’s innovation with AI to assist content recommendation and advertising automation processes, as well as improved monetisation of Reels, its short-form video product.

WARC Media’s latest Platform Insights report provides an overview of the key data-points that advertisers should know about the platform spanning investment, consumption and performance.

WARC Media forecasts quarterly advertising revenues of $17.7bn in Q4 2023, up 25.8% year-on-year, and predicts its global ad revenue to reach $71bn in 2024

Instagram has recovered strongly following a largely flat 2022 as a result of Apple’s App Tracking Transparency (ATT) policy, alongside a broader slowdown in digital ad investment.

Buoyed by innovations in AI targeting to boost consumption levels, spanning content recommendation and asset creation, and improved monetisation of Reels, WARC Media forecasts Instagram to post quarterly advertising revenues in Q4 2023 of $17.7bn, up 25.8% year-on-year, and reach a total of $71bn in 2024.

The growing popularity of social commerce is moving Instagram closer to the point of purchase. The global retail category spend on Instagram will rise from $3.2bn in 2020 to a forecasted $9.1bn in 2024 per WARC Media. Ahead of retail spend, business and industrial ad spend is expected to reach $10.2bn globally, whilst other categories have modest growth.

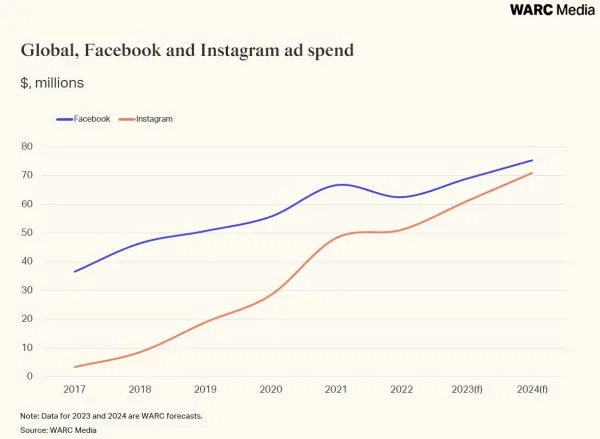

At the current trajectory, it is only a matter of time before Instagram surpasses Facebook to become the world’s largest social media platform by ad revenue.

Reels is key: Campaigns on Reels reach nearly twice the audience as those on TikTok. Nearly a third (30.4%) of consumers turn to Instagram when searching for brands

Instagram’s global monthly advertising reach has continued to stand at 1.3 billion over the past two years, slightly ahead of that of TikTok, according to Kepios.

However, the pivot to short-form video with Reels, introduced in 2020, is proving popular with users and brands alike, with plays already exceeding 200 billion per day across Meta products.

Data from Emplifi suggests that campaigns running on Reels will reach, on average, nearly twice the audience as those on TikTok. According to Emplifi, Reels outperformed all other content types on Instagram, generating 55% more interactions than single image posts and 29% more interactions than standard video posts.

According to GWI, nearly a third (30.4%) of consumers turn to Instagram when searching for brands and campaigns.

Instagram’s usage among both Gen Z and Millennials has increased over the past year, in part due to its push into Reels, reaching 60% of younger audiences, ahead of TikTok and Facebook (both 38%).

Instagram is the most popular choice for 90% of influencers

Brands are increasingly partnering with creators to reach niche audiences and find the right cultural moment, and to connect with communities with authenticity.

Central to Instagram’s success is its traditional primacy as a platform for creator and influencer content albeit a dominance being challenged by TikTok.

Instagram is the most popular choice (90%) for influencers, followed by TikTok (63%). 7% of influencer content on Instagram is sponsored.

Featured image: Souvik Banerjee / Unsplash