What makes art valuable?

To be more accurate — and avoid extremely complex conversations about hedonic and cultural and other sorts of ‘value’ that cannot be contained in this column — what makes any particular piece of art worth more money than another? This is still a staggeringly complex question but let’s have a go at it. What makes the Mona Lisa the most valuable painting in the world? OK, again we get into tricky territory here because most ‘old masters’ are held by galleries and never sold so they are worth what insurance says they’re worth, but it’s a little abstract.

Arguably the Mona Lisa, by Italian Renaissance creative director Leo DV, is priceless to France. That said, it is understood to be the most valuable painting in the world and is also the most famous painting in the world. Neither of these things were true for most of its existence. It spent many years in the bath/ bedrooms of French Kings and then in Napoleon’s. Its associations with such enmities made it interesting to the upper echelons of society, and then in 1911 it got stolen and became suddenly much more famous, and then much more valuable.

This is, pretty much, how the value of a piece of art is accrued over time. Art’s value, as an asset class, is primarily a function of provenance, historical importance and therefore status value and investment potential. All of this is a function of fame. Take provenance as an obvious example — is this painting really by a particular, famous and therefore valuable, artist or not? The nominal scarcity of works by a dead artist is a function of the demand for that particular artist, which changes over time. As with Napoleon, prior owners matter too. Rothko’s White Center was owned by The Rockefeller family and became known as the Rockefeller-Rothko, which greatly increased its value.

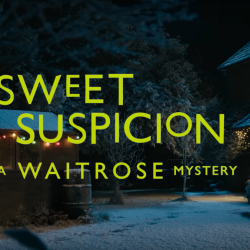

Today’s most expensive living artist at auction is Jeff Koons, a celebrity styled heartthrob artist obsessed with celebrity and, like Warhol before him, how mass-produced things become famous and have value. He made a very famous series of graphic work with his partner Cicciolina, a pornographic actress and, later, Italian politician.

This work scandalised the art world, made mainstream news and catapulted him to stratospheric fame (his most recent work was sent to the moon and involved NFTs or something). One last example — remember that Banksy piece that shredded itself at auction and became much more valuable?

Art is a primarily symbolic good, and isn’t the same as selling sugar (or just plain) water, but it has lessons to teach us. This is delightfully instantiated in the Droga5 work for Christie’s auction house called The Last Da Vinci, which propelled the auction of Da Vinci’s (confirmed as real but really who knows) Salvator Mundi to end in the largest ever sale price of a piece of art, at almost half a billion dollars. Yes, we use the same tools because we believe good art to be good selling (thanks, Bernbach), but it also tells us about how brands generate supra-linear growth against the category, and even sales volume through pricing power.

In essence, the business of art is fame, to create a brand that people think is worth buying, somewhat abstracted from the cost of time and materials involved, which creates substantial margin opportunities for artists like Jeff Koons

The biggest brands in the world can also do this, as had been aptly demonstrated over the last few years of inflation, during which CEOs and CFOs couldn’t contain their joy on earnings calls about how they could raise prices and see no particular impact on demand. This value rather than volume growth isn’t infinitely elastic and thus we have seen value meals reappear at various fast food retailers recently.

Fame feels like a fluffy word, but as Feldwick has pointed out it seems to be a crucial cultural component of the success of the biggest brands. Of course, there are inherent causality issues here, since bigger brands will be more well known because more people buy them. That said, ITV did some interesting fame research attempting to demonstrate its direct impact on the bottom line back in 2005.

The thesis is that fame is inherently human and it was originally pinned to ability, all the way back to the best hunters in the tribe. One of the earliest statistical models of fame looked at WW1 fighter-pilot ‘aces’ and showed that achievement correlated with fame even after many years. This sense that fame and achievement co-exist seems hard-coded into our brains, and this is part of how advertising adjusts our evolutionary understanding for commercial benefit.

ITV broke out five elements of fame and did the modelling to show that fame correlates strongly with both higher ROI in performance media and higher stock prices, both conversations we are still having today. Fame is some kind of aggregated (you can’t be famous to one person) persistent attention that creates fluency, familiarity and thus, usually, favourability.

By definition, and because of Double Jeopardy, older bigger brands have much more existing fame equity to leverage in the market, which makes their advertising more efficient and possibly more effective as well. Today we have a functionally infinite media-scape that churns in real time, which means that things can become famous very quickly but often not for very long or in a predictable way. I doubt the Hawk Tuah girl was expecting this and I wish her the very best in developing a media career out of her viral moment. That, however, cannot be how we build brands, by hoping for viral moments, despite what some agencies might still promise. This makes the job of strategic advertising harder, because having enough money to buy 1+ reach against a whole buying audience is the reserve of brands that are already big enough to do so (the time of VC funded unprofitable monopoly seeking is over for the foreseeable future).

How do brands attract attention today, understanding the cacophony and endless fragmentation of the media market and current culture? Thinking with PR enabled creativity seems crucial if you can’t afford the reach but are we just writing advertising for the algorithms today, rather than actual people? And who is doing it well?

I’m delighted to announce we’ll be chatting to Andy Pearson, VP of Creative at Liquid Death, ultra runner and co-creator of the game Judgy-Mcjudgerson (which he and his partner developed with agency Humanaut) on the MediaCat podcast, about exactly all these things very soon.

Featured image: Steve Johnson / Unsplash