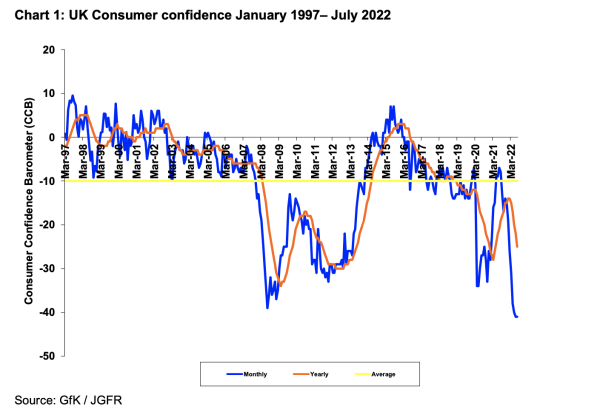

The monthly UK Consumer Confidence Barometer (CCB), undertaken by GfK is unchanged on the month at -41, the lowest score since the measure began in 1974 and 32 points below July 2021 (-9).

Confidence fell in 2, rose in 2 and is unchanged in 2 of the 6 major UK regions. The biggest fall is in Wales, down 6 points to -49 and dropped 2 points to -42 in the Midlands. Biggest gain on the month is in Northern Ireland, up 14 points to -44 with a smaller gain of 5 points to -42 in Scotland. In the North (- 47) and the South (-36) sentiment is unchanged on the month.

Of the 5 sub-measures comprising the headline measure:

- The financial situation of households over the past 12 months is down unchanged at -23 on the month, and down 22 points on a year ago (-1)

- The expected financial situation of households over the next 12 months is up 2 points on the month at -26; 37 points down on 12 months ago (+11)

- The general economic situation score over the past 12 months is 1 point lower on the month at -66, and 23 points below 12 months ago (–43)

- For the coming 12 months the general economic situation measure is unchanged at -57, 52 points below July 2021 (-5)

- The measure of consumer sentiment to making major purchases in view of the current economic situation is 1 point higher on the month at -34 but is down 36 points on 12 months ago (+2)

The survey also asks other questions about spending and saving. Expected spending on major purchases (such as furniture or electrical goods) in the next 12 months compared with the previous 12 months is 2 points up at -29 in July but 26 points down vs July 2021 (-3). Overall spending confidence on major purchases of household goods edged 3 points up on the month to –63 and is 62 points down on 12 months ago (-1).

Saving confidence improved in July

52% of consumers are likely to save in the next 12 months, up from 50% in June, but down from 65% in July 2021. 52% of adults believe it to be a good time to save (50%, June, 57% July 2021). Compared to June (+14) saving confidence is 8 points higher (+22) but 30 points down vs July 2021 (+52). Currently 50% of households are saving, up slightly from 49% in June but well below 61% a year ago. Households overall financial position (+16) is 1-point better vs June (+15) but 16 points below July 2021 (+32) and 5 points below the long-term average of +21.

The jobs outlook measure worsened by 1 point on the month to +31 vs June and worsened by 7 points vs July 2021 (+24). A higher score represents rising unemployment expectations. A net balance of 39% of adults (37%, July and 22% a year ago) believes unemployment will rise in the next 12 months. The measure of inflation expectations improved slightly on June, 4 points better at +109, while the measure of inflation over the past 12 months (+115) worsened by 2 points on the month. June’s Inflation Index combining current and future measures is +224, a 2-point improvement vs June.

The JGFR Financial Wellbeing Index improved in July, up by 10 points vs June to -104 but is 180 points below 12 months ago (+76), while the JGFR Feel-Good Index improved by 5 points to -103, the fourth successive monthly gain, but down 116 points vs July 2021 (+13).

John Gilbert, Director, JGFR commented: “While headline confidence continues at a record low, slight gains in the Feel-Good, Financial Wellbeing and Inflation indices suggest consumers may be adjusting to the current stage of the cost-of-living crisis. Renewed economic and political uncertainty in the face of high inflation and low growth are set to trigger more consumer angst with a rise in interest rates also imminent adding more pressure on households and businesses.”