The monthly UK Consumer Confidence Barometer (CCB), undertaken by GfK is 1 point lower on the November measure at -15 and is 11 points above December 2020 (-26).

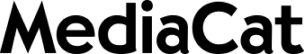

Confidence rose in 3 of the 6 major UK regions. The biggest gain on the month is in Wales, 10 points higher at -21, with sentiment in Northern Ireland up 4 points to -11 and in the South up 3 points, boosted by a 15-point jump in London. In Scotland confidence is unchanged (-19), while in the North (2 points down at -20) and in the Midlands (dropping 7 points to -18) confidence fell.

Of the 5 sub-measures comprising the headline measure:

- The financial situation of households over the past 12 months is up 2 points to -5 on the month, and up 4 points on a year ago (-9).

- The expected financial situation of households over the next 12 months is 1 point down on the month at +1, 2 points down on 12 months ago (+3).

- The general economic situation measure over the past 12 months edged 1 point higher on the month to -39, and is up 26 points on 12 months ago (-65).

- The general economic situation measure in the coming 12 months slipped by 1 point to -24, but is 11 points higher than in December 2020 (-35).

- The measure of consumer sentiment to making major purchases in the current economic climate shed 3 points on the month to -6, but is up 16 points on 12 months ago (-22).

Saving confidence on the fall

The survey also asks other questions about spending and saving. Expected spending on major purchases (such as furniture or electrical goods) in the next 12 months compared with the previous 12 months is 4 points lower at -11 in December but is up 12 points vs December 2020 (-23). Overall spending confidence on major purchases of household goods declined by 7 points on the month to – 17 but is up by 28 points on 12 months ago (-45).

Saving confidence fell in December for the third successive month. 58% of consumers are likely to save in the next 12 months, unchanged on the month, but down from 60% 12 months ago. 51% of adults believe it to be a good time to save (52% November, 53% December 2020). Compared to November (+35) saving confidence is 2 points lower (+33). Currently 55% of households are saving, unchanged vs November but 1 point down on 56% a year ago. Households overall financial position (+24) is 1 point down vs November (+25) and vs December 2020.

Unemployment expectation on the rise

The jobs outlook worsened on the month, 3 points lower (+20) vs November (+17) but up 32 points on a year ago (+52). A higher score represents rising unemployment expectations. A net balance of 22% of adults (20%, November and 60% a year ago) believes unemployment will rise in the next 12 months. The measure of inflation expectations is little changed in December, 1 point lower at +102, while the measure of inflation over the past 12 months (+98) worsened by 5 points on the month, continuing at a multi-year high. December’s Inflation Index combining current and future measures is +200, just short of October’s Millennium high (+202)

The JGFR Financial Wellbeing and JGFR Feel-Good Indices worsened in December. The former fell by 8 points vs November to +24 but is 36 points higher than 12 months ago (-12), while the latter fell by 4 points to -29 but is up 28 points on a year ago (-57).

John Gilbert, Director, JGFR commented:

“For the second successive Christmas consumers have little to celebrate as another Covid variant sweeps across the country, with the health of consumers, the state of the NHS and the economy looking increasingly at risk. While confidence ends 2021 higher than in 2020 the consumer mood for 2022 is set to start in downbeat mood despite the vaccine boosters.”

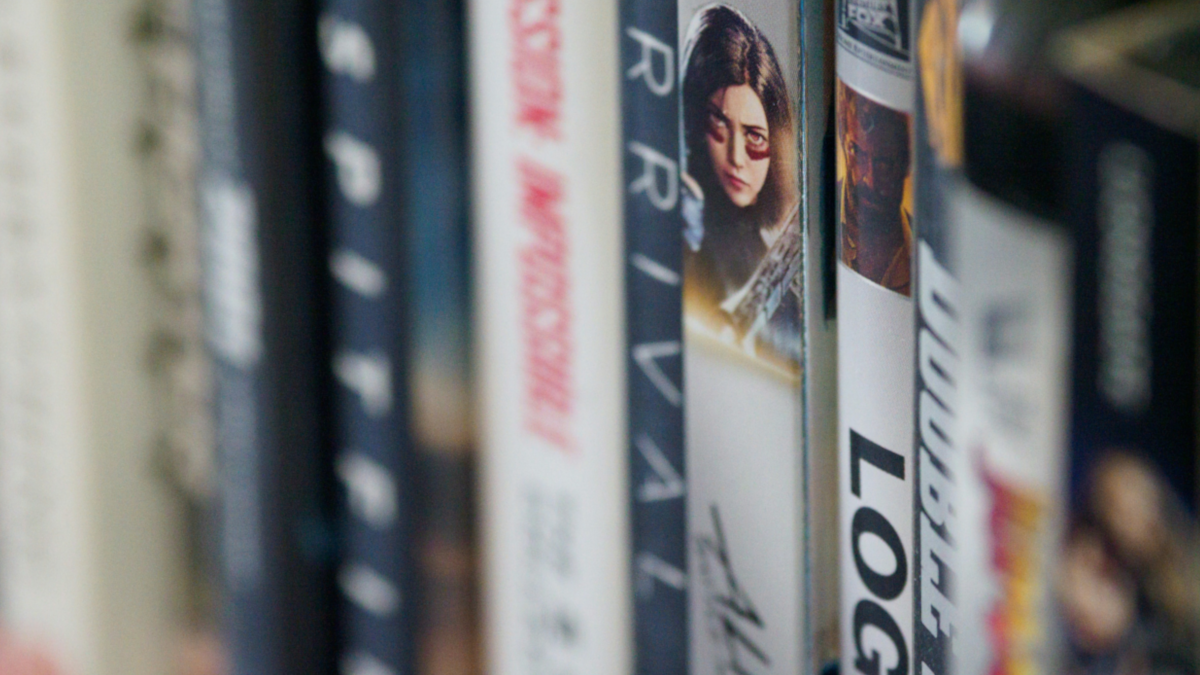

Featured image: Jordan Brierley / Unsplash