The monthly UK Consumer Confidence Barometer (CCB), undertaken by GfK, is up 3 points on the October measure at -14 and is 19 points above November 2020 (-33).

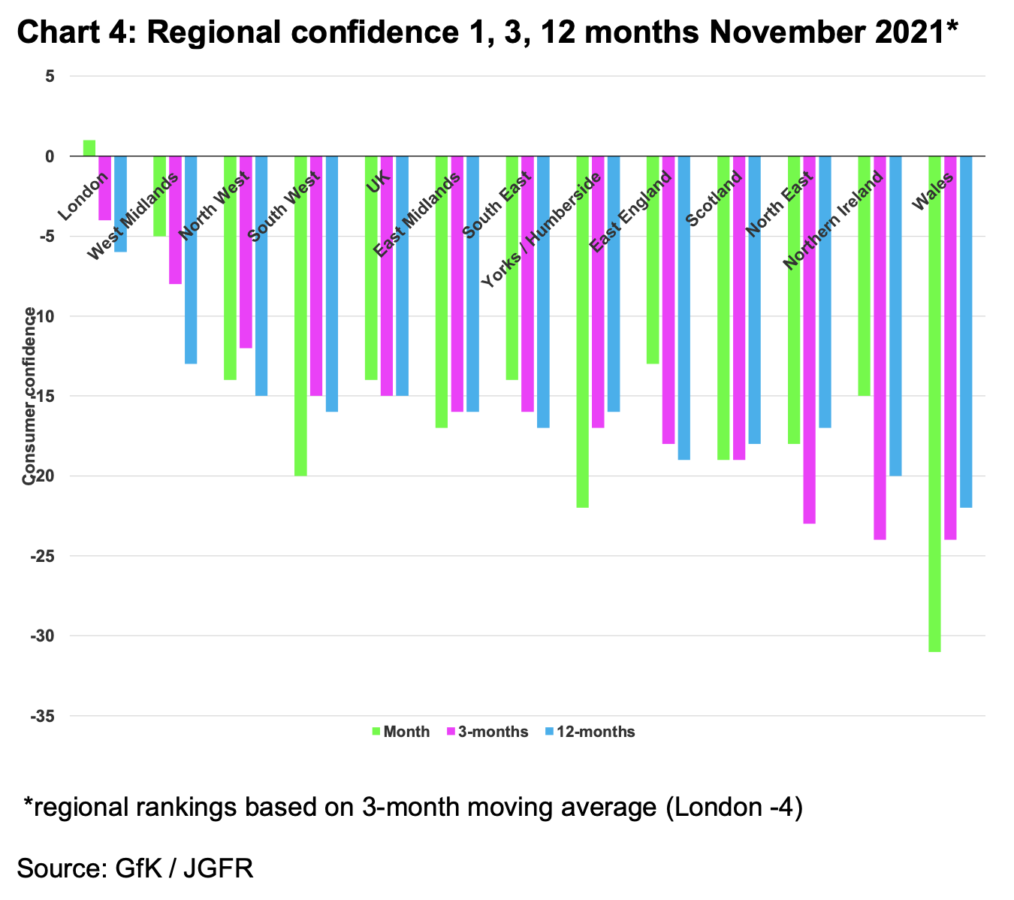

Confidence rose in 4 of the 6 major UK regions. The biggest gains on the month are in Northern Ireland, 15 points higher at -30 and the Midlands, 5 points higher at -11. In the South sentiment improved by 3 points to -13 while in Wales confidence edged 2 points higher to -31. Sentiment in Scotland is unchanged at -19 and in the North at -18.

Of the 5 sub-measures comprising the headline measure:

- The financial situation of households over the past 12 months is down 2 points to -7 on the month, but up 9 points on a year ago (-16)

- The expected financial situation of households over the next 12 months is 1 point up on the month at +2, 7 points up on 12 months ago (-5)

- The general economic situation measure over the past 12 months gained 6 points on the month to -40, and is up 27 points on 12 months ago (-67)

- The general economic situation measure in the coming 12 months rose for the first month in 6 months, up 3 points to -23, and is 27 points higher than in November 2020 (–50)

- The measure of consumer sentiment to making major purchases in the current economic climate jumped 7 points on the month to -3, up 25 points on 12 months ago (-28)

Spending on the rise, saving on the fall

The survey also asks other questions about spending and saving. Expected spending on major purchases (such as furniture or electrical goods) in the next 12 months compared with the previous 12 months is 8 points higher at -7 in November and is up 22 points vs November 2020 (-29). Overall spending confidence on major purchases of household goods surged by 15 points on the month to –10, up 47 points on 12 months ago (-57).

Saving confidence fell in November for the second successive month. 58% of consumers are likely to save in the next 12 months, down 3 percentage points on the month, unchanged vs 12 months ago. 52% of adults believe it to be a good time to save (57% October, 51% November 2020). Compared to October (+45) saving confidence is 10 points lower (+35). Currently 55% of households are saving, down from 56% in October but up from 53% a year ago. Households overall financial position (+25) is 1 point down vs October (+26) but is up 3 points vs November 2020 (+22).

Unemployment expectation falls

The jobs outlook improved on the month, 6 points higher (+17) vs October (+23) and up 36 points on a year ago (+53). A higher score represents rising unemployment expectations. A net balance of 20% of adults (25%, October and 60% a year ago) believes unemployment will rise in the next 12 months. The measure of inflation expectations fell in November, down 6 points to 103, while the measure of inflation over the past 12 months (+93) is unchanged on the month, continuing at a multi-year high.

The JGFR Financial Wellbeing and JGFR Feel-Good Indices improved in November. The former gained 14 points vs October to +32 (-53 November 2020) while the latter rose for the first month since May, up 16 points to -25, and is up 55 points on a year ago (-80).

John Gilbert, Director, JGFR commented:

“While November’s confidence measure shows an improvement vs October and 12 months ago, boosted by a jump in spending confidence, the coming months look set to see the economy wrestling with rising inflation as supply falls short of demand across many economic activities and household finances come under pressure. ‘Having enough money to live right on’ is the biggest concern among consumers and looks set to be for some time.”

Featured image: GoodStudio / Shutterstock.com