I am typing this in a Marimekko sweater that seemed like an essential purchase during my last trip to Finland, a pair of black pants from a brand called Residus whose tagline is ‘luxury that won’t f**k up the planet’ and my shoes are James Perse that I bought at a sample sale. To quote the Kinks, I am indeed, a ‘dedicated follower of fashion.’

Fashion can be a wonderful form of self-expression, and many brands have their own style that we co-opt for ourselves, or see in others. Upon seeing Australian fashion brand Zimmerman, I think of my friend Kirsty, while Camilla and her flowing kaftan styles, that is definitely Elke. However, while fashion brands can cultivate their own specific aesthetic, and that aesthetic might appeal more to some than others, does this affect brand buying? Do people buy fashion brands differently to other categories such that the typical rules of brand growth don’t apply? Rather than speculate, let’s explore some empirical evidence.

Double Denim or Double Jeopardy?

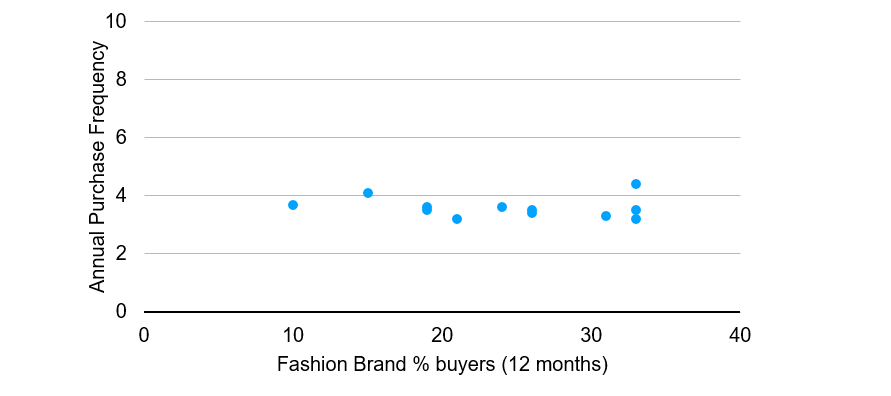

Do fashion brands have a passionate following whereby only a small group may buy the brand, but those that do are highly loyal? Or, in line with the law of Double Jeopardy, do brands vary much more in the size of their customer base, than the loyalty of buyers? Here is an example that includes a range of mainstream fashion brands, such as Uniqlo, Hollister and Zara. Figure 1 plots the percentage of category buyers that bought each brand in the last 12 months by the loyalty to each brand, which in this case is many times the brand is bought in a year by its buyers.

The results show the data is a virtual flat straight line. Therefore, despite the large differences in penetration (from 10% to 33%), each brand is bought around four times a year. While penetration varies 3x, loyalty hardly varies at all, and the Law of Double Jeopardy holds.

Fashionista = brand lover or lover of brands?

As much of what we wear can be about self-expression, it’s perhaps reasonable to think that once someone finds a brand that suits them, they will concentrate their purchases to be with brand, eagerly awaiting the new season’s drop before they buy. Therefore, all a fashion brand needs to do to be successful is to find ‘its tribe’, cultivate them over time by consistently meeting their needs, and wait to be rewarded by ‘locked in’ loyalty.

However, in most categories, sole loyalty is rare, and usually the domain of light category buyers. We see this in data across 19 high-end leather goods brands (selling handbags, wallets, belts, etc.,) showing over a three-year period, only 28% of all category buyers only bought from one brand, which means 72% of category buyers bought from two or more brands.

The percentages are low for specific brands. For example, amongst buyers of Michael Kors, only 13% just bought Michael Kors — which means 87% bought Michael Kors and leather goods from at least one other brand in those three years; while amongst buyers of Burberry, only 5% just bought Burberry in that period.

Sole loyalty is higher for Michael Kors because Michael Kors has a higher penetration than Burberry in the USA, in line with the well-established empirical pattern that brands with more buyers also have slightly more solely loyal buyers.

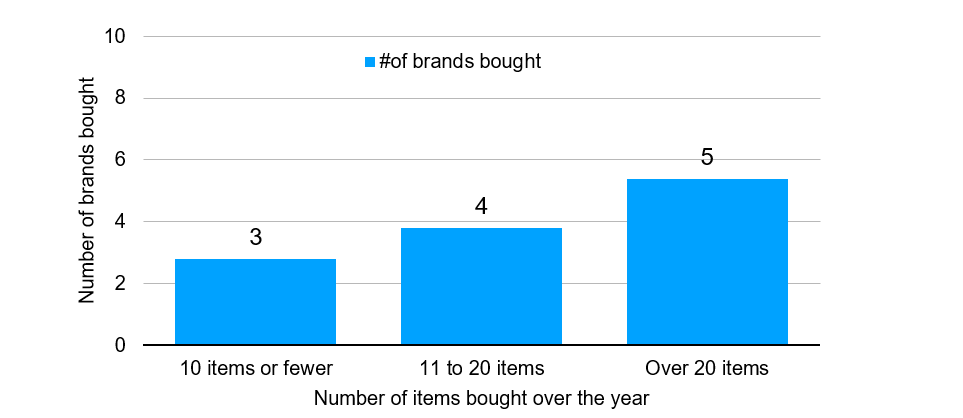

Most people buy from multiple fashion brands, even within a product sub-category such as leather goods. We find typically heavier category buyers buy from more brands than lighter category buyers. Figure 2 is an illustration of this pattern from clothing fashion brands in the USA. Buyers who bought more clothing items bought from more brands than those who bought fewer clothing items.

The laws of (fashion) brand growth

When we think of fashion laws, it usually helps us avoid a fashion faux-pas with advice such as ‘match your belt with your shoes’ and ‘blue and green should never be seen, unless there is a colour in between’. Now we have marketing laws to avoid a marketing faux-pas, but the twist is when it comes to brand growth, fashion brands, and even luxury fashion brands, follow the same style guide as brands in other categories such as detergent, deodorant or insurance.

I only had space to show you two types of laws here, but there are others that hold too. If you are involved with a fashion brand, I encourage you to review How Brands Grow 1 & 2, and there you will find other laws such as the Natural Monopoly Law, Brand User Profiles Hardly Differ and Duplication of Purchase Law, all of which apply to fashion brands and have big implications for how to grow brands. I will end with a brief summary on what the laws covered here mean.

The law of Double Jeopardy tells us that growth comes from having more customers buying from you in any period. Therefore, a key objective of marketing should be acquisition of more brand buyers. This means designing a marketing plan that reaches out beyond current brand buyers, to category buyers who know little, if anything, about your brand, and build Mental Availability so the brand has a chance of being thought of next time that buyer is in a buying situation.

That there are few solely loyal buyers tells us tactics such as loyalty programs should be seen as ‘promotional’ tools to reward customers for past purchases. However, don’t expect the customer to ‘reward’ the brand back by being extra loyal.

And, of course, there is Physical Availability, which is about the brand being easy for category buyers to find and buy. In today’s fragmented omni-channel environment, having widespread presence, standing out from the crowd, and having a good product range all help you capitalise on the Mental Availability your brand builds.

For more on how to build Mental and Physical Availability, see:

Romaniuk, Jenni and Byron Sharp (2021), How Brands Grow: part 2 (2nd ed.). Victoria, Australia: Oxford University Press.

Featured image: Erik Mclean / Pexels