It’s crazy how many martech solutions there are — it’s in the thousands, and we don’t seem to be anywhere near the peak. That means every November, LinkedIn is flooded with companies shouting about their annual trends report. Real talk, we’re one of them.

This isn’t your average trends piece though — it’s one of the few that explores who’s driving these shifts, not just what’s trending. If you don’t have time to read the full report, we’ve got you covered.

Here’s a customised digest for all you marketers, media professionals, and tastemakers.

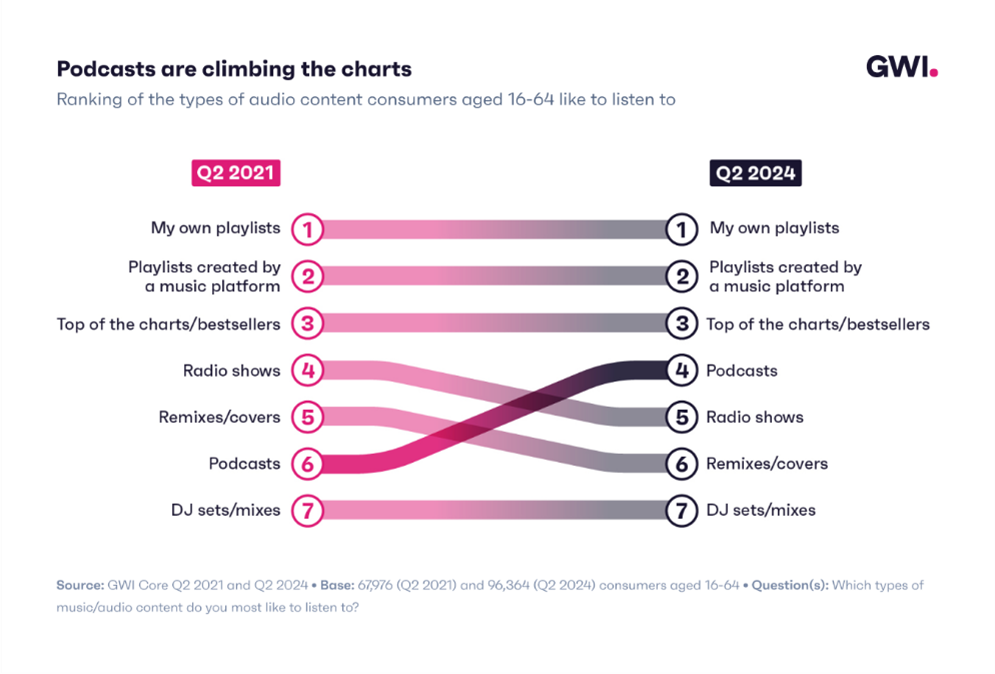

Why we’re talking about podcasts (again)

If, 24 months ago, you’d have asked us whether podcasts would make it into 2025’s report, we’d probably have said no, as engagement and investment in them had dipped. But technologies can and do get a second wind; just look at smartwatches or QR codes. And we have reason to believe podcasts are set to have one, given the number of new milestones they’ve celebrated recently.

Today, more people like listening to podcasts than radio shows or remixes. 2024 was also the very first year that more of us said we listen to podcasts on a typical day than read physical press or use a games console. We have a certain amount of time to consume content each day, and all that reshuffling suggests relatively more of it will be going to podcasts in future.

Chances are, it won’t be long before we start seeing further shifts. The ‘podcast election’ couldn’t have come at a better time for us (it’s almost like we predicted it…), and brands needn’t doubt the medium’s staying power. If you haven’t already, it’s worth seeing whether your target customers are among those tuning in more. Stay-at-home parents, people in senior management roles, and online press readers are just some of the groups riding the latest podcast wave.

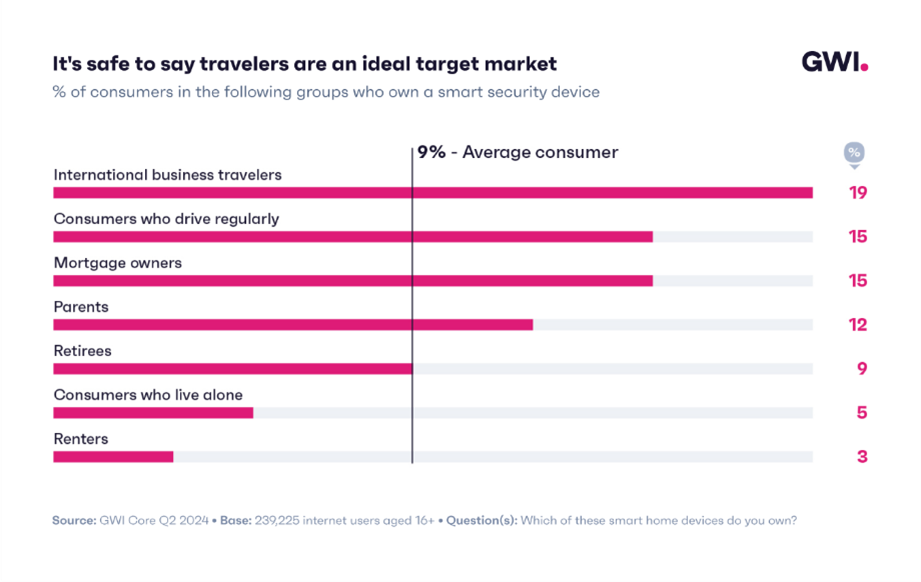

Smart security is guarding more than just doors

Our next trend hasn’t just been underestimated at times; it’s largely slipped under the radar. While most of us wouldn’t share pictures of our Ring doorbells on Instagram, that doesn’t mean they aren’t popping up on people’s doors. Not only has smart security ownership exploded by a staggering 153% since 2019, but these products have quietly snagged a bigger share of the market than smart utility devices.

And zeroing in on who’s more likely to own one says a lot about why; that’s consumers who use food delivery services, retirees, parents, and business travellers — just to name a few. The types of people who want to keep an eye on their home while they’re away, want another pair of eyes on their kids, or spend a lot of time indoors. Going forward, campaigns should be super clear on the groups they’re targeting and showcase their most relatable reasons for using one — Arlo gets it.

Energy drinks are offering a different kind of buzz

This next story links back to other trends we’ve covered. Word on the street is Gen Z aren’t downing as much alcohol. Beyond that, less of them are smoking and not as many drink coffee.

But we all get a boost from somewhere, whether that’s from vaping, CBD-infused mocktails, or… energy drinks. In fact, more 20-29s now drink them than beer, and that’s been the case since 2022.

It’s not just young men driving this trend either. Mums, 45-54s, finance workers, and people interested in personal healthcare have all seen bigger-than-average jumps in energy drinks consumption since 2019.

Other brands have started to notice the space becoming more diverse or are actively working to draw in new audiences. Drinks are being marketed as health products — for example, Tenzing and Huel, which include a cocktail of vitamins. And we reckon there are plenty of other untapped gaps in this market — you just need data to find them.

Women’s sports are holding out for the right partners

Last on the digest is women’s sports, which are scoring big in places and even starting to rival men’s tournaments on occasion. More global consumers said they watched women’s gymnastics during the 2024 Olympics than any other men’s competition, which is an impressive achievement. And marketers are considering the quality over quantity argument too, given women’s sports audiences tend to engage on a deeper and more meaningful level.

That means a lot more competition for partnerships and only a select number of places. For interested brands, it’ll all come down to your pitch.

Last month, we sat down with the CEO of USA Gymnastics, Li Li Leung, who said the organisation is keen to build an uncluttered, value-driven portfolio. They want brands that resonate with their fanbase, value their athletes, and are committed to real activation. And here’s the kind of insight that’ll help make your case: people who follow gymnastics are much more likely to want brands to be trendy, to buy healthy foods, and to be eyeing up a luxury car or minivan.

Featured image: Nick Wehrli / Pexels