Adwanted’s annual conference, The Future of Media, took place on 8-9 October at Kings Place in London. Powered by The Media Leader, the event brought together hundreds of senior media professionals and speakers from world-renowned companies including Global Media, dmg media, Channel 4, Sky, dentsu, Publicis Media, WARC, ISBA, and UM. Having attended both days of the conference (read our Day 1 and Day 2 recaps), MediaCat identified four key takeaways.

Future of media is digital

Top of mind at the Future of Media were shifting media consumption trends and media investment. In line with the developments of the last several years, both media consumption and media investment are becoming increasingly digital.

According to WARC data, the share of total time for online media consumption has risen from 43% in 2015 to 63.3% in 2024. Across generations, consumers are increasingly consuming media digitally, with even baby boomers catching up to younger generations in digital media consumption.

WARC revealed earlier this year that ad spend is set to reach £1 trillion in 2024, which constitutes a 10.5% growth YoY. The majority of the growth is driven by ad spend going to the pockets of only three companies: Alphabet, Amazon and Meta.

In the upcoming year; consumption on social is set to increase by 6.7%, stated WARC’s Alex Brownsell, whereas consumption on streaming is due for a 16.8% increase, online press a 26% increase and video streaming a 32% increase. Tragically, increases in ad spend don’t necessarily follow consumption – CTV is projected to reach $30.3b next year, whereas social media will add on a whopping $170b, but online newsbrands are expected only to add $1.1b in ad revenue globally, even though consumption is set for considerable growth.

Creativity is not under threat

The constant discussions surrounding artificial intelligence and new technologies have unsurprisingly resulted in concerns about creativity and whether it is under threat. At the Future of Media conference, multiple speakers alleviated these concerns. Some, including dentsu’s Jenny Bulis and Bicycle’s Graeme Douglas, argued that creative is a driver of media effectiveness, and it’s becoming ever more tech-driven. Meanwhile, others such as Pearl & Dean’s Kathryn Jacob OBE and Brainlabs’ Sue Unerman shared that AI cannot replace human creativity.

Taking a case in point, they argued that GenAI could not have come up with the plot for the 2023 Barbie film or the idea of launching Oppenheimer at the same time, ultimately creating the cultural phenomenon that was Barbenheimer. Explaining why GenAI would have failed in this case, they said: ‘Data takes you to one point — it tells you where you have been but not where to go.’

Cross-media measurement remains a problem

The top concern among brands and agencies during the two days of Future of Media was the difficulty around cross-media measurement, a result of today’s fragmented media space. In a session hosted by OMD and On Device, in which the two companies talked about how they collaborated to measure Pepsi’s cross-media campaign, the panelists mentioned a Nielsen survey that found 62% of brands use one or more measurement partners, and 15% use more than 5.

Adidas Director of Media Measurement and Learning Gordon Black emphasised this point, mentioning the difficulties around measuring the impact of one campaign activity in the current media space. In the same panel, ScanmarQED’s Phil Spencer revealed that brands are increasingly building their own measurement capabilities in-house, partly because it’s more cost-effective, but also to keep their data private.

This was echoed by Twinings’ Head of Strategy and Insight Adam Smith, who mentioned that the brand invests in various media channels but can’t use the data from these investments for measurement because media owners are reluctant to share.

ISBA leader Phil Smith was in attendance to talk about the launch of Origin, the trade association’s response to the concerns around cross-media measurement, which aims to provide real-time campaign data across YouTube, Meta and linear TV. Although Origin has been rolled out to 35 of the UK’s biggest advertisers, the initiative has faced criticism from the industry with stakeholders voicing concerns around the omission of Barb data.

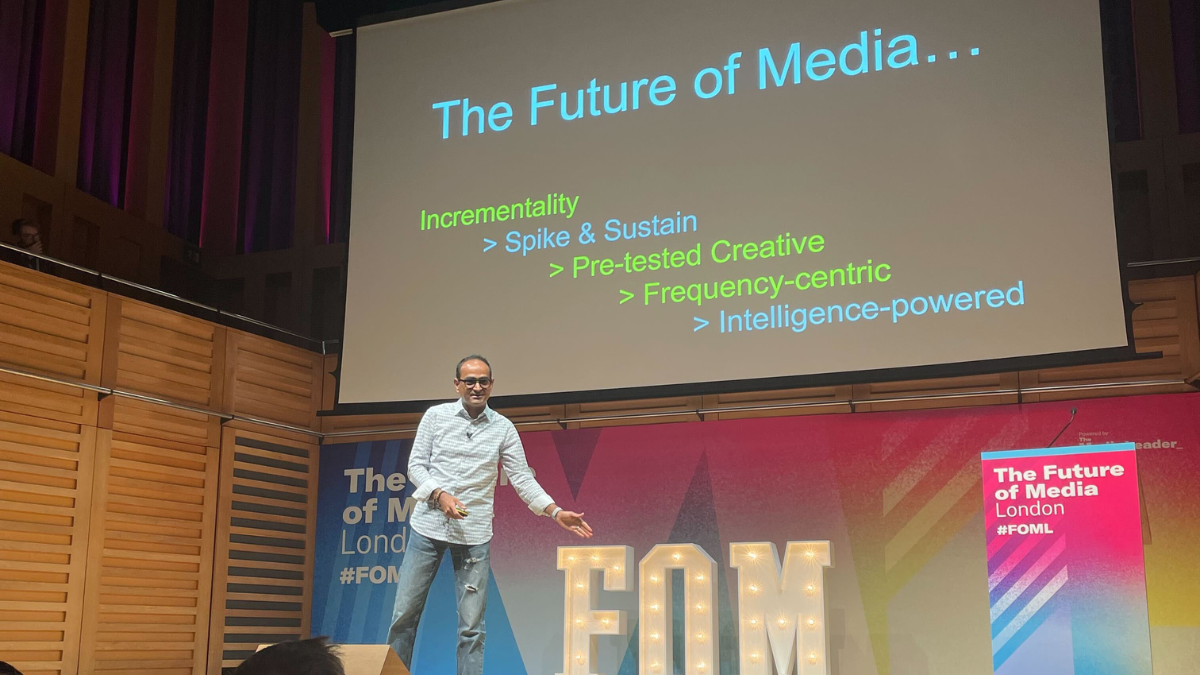

Looking beyond traditional metrics

Agencies and brands alike agree that advertisers must look beyond traditional metrics and reevaluate their reliance on reach-centric media planning. Croud’s Avinash Kaushik honed this point, explaining that reach-centric planning bombards consumers with ads, but fails to drive sales. Although reach-centric media planning can win creative awards, it fails when it comes to conversion. For this reason, Kaushik proposed prioritising frequency-centric media planning and researching how many times an ad should be presented to a consumer over a certain period before allocating one’s budget.

In a panel discussion on connecting with consumers on an emotional level, Vodafone’s Lisa Walker echoed the need to look beyond reach, saying: ‘We got lost in clicks and data. Use data but remember its place. It needs to serve a goal.’

Featured image: Future of Media